The policy limiting cash withdrawals was defended by the Central Bank of Nigeria on Thursday, stating that it was not intended to target the weak.

Aisha Ahmad, the CBN’s deputy governor for financial system stability, defended the policy while testifying before the House of Representatives and asserted that Nigeria could run a cashless economy, noting that 82% of cash withdrawals from corporate accounts and 94% of withdrawals from personal accounts fell below the revised weekly limit of N500,000.

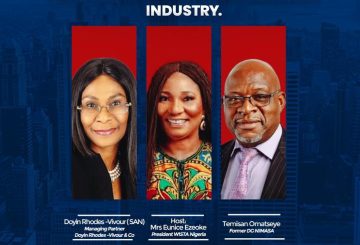

Godwin Emefiele, the governor of the Central Bank of Nigeria, was represented by Aishah Ahmad. Emefiele had twice failed to show up in front of the lawmakers to defend the policy, which had drawn a strong backlash from Nigerians.

The House had been informed by the apex bank that Ahmad will represent the Committee of Governors in front of the MPs rather than Emefiele, who would not personally appear before the House.

The CBN deputy governor also made note in her presentation to the House that despite concerns from certain critics over the paucity of commercial bank branches, particularly in rural regions, evidence gathered by the CBN revealed that individuals in remote areas had embraced internet banking choices.

The CBN ordered 500 million of the newly designed N200, N500, and N1,000 notes through the Nigerian Security Printing and Minting Plc, Ahmad added.

The cashless policy was first introduced in 2012 and was based on sections 2(d) and 47 of the CBN Act, which Ahmad requested five minutes from the MPs to clarify.

She also noted that the CBN started the pilot test in Lagos State, where it established restrictions on transactions of N500,000 and N3m for individual and corporate users, respectively, and with fees for any sum above these.

She continued, “The pilot was very successful and following that, the policy was extended to six other states – Abia, Anambra, Kano, Ogun and Rivers – in July 2013. Over the years – and it has been 10 years now since we first launched this – the policy had been amended severally due to feedback from stakeholders and also to ensure that we develop the infrastructure and financial access points required to support the policy.

“We suspended processing fees on excess lodgment in the past, in 2014. In 2017 and 2019, we also suspended the nationwide rollout of the cashless policy. Currently, we suspended fully any payments or charges on excess lodgment.”