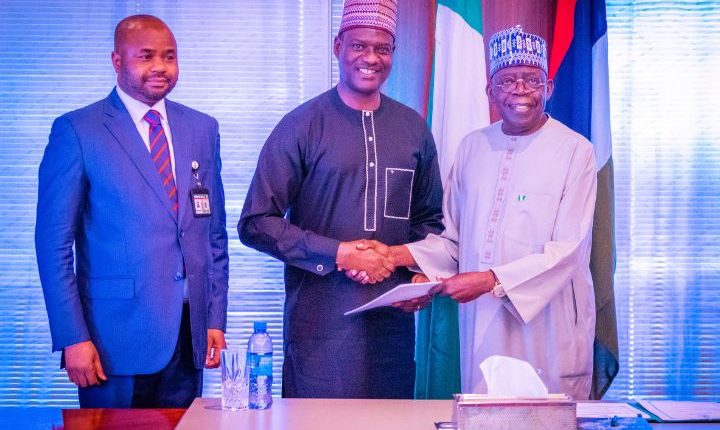

In a significant move aimed at improving the efficiency of Nigeria’s tax system and easing the burden on its citizens, the Presidential Committee on Tax Reforms and Fiscal Policy is diligently working towards streamlining the complex tax structure in the country. The committee, under the leadership of Chairman Mr. Taiwo Oyedele, is on a mission to simplify Nigeria’s tax landscape by reducing the multitude of officially collectible taxes and levies, which currently exceed 60, to a more manageable single-digit number.

Mr. Oyedele outlined the committee’s objectives during a recent briefing with State House correspondents, stating that the ultimate goal is to consolidate these taxes across all levels of government and significantly reduce the total number to less than 10.

The complexity of Nigeria’s tax system has long been a concern for both the government and its citizens, with Mr. Oyedele revealing that unofficially, there are more than 200 different taxes in Nigeria. This has placed a substantial burden on the population and created challenges for individuals and businesses alike.

Moreover, a staggering 96% of the total revenue collected by federal, state, and local governments in Nigeria comes from a small set of fewer than 10 taxes. The committee views this disproportionate reliance on a handful of taxes as a pressing issue that needs to be addressed through reform.

To tackle the intricate web of tax laws and regulations, the committee has actively engaged with the Senate and the House of Representatives to initiate the necessary reforms. Public consultation and stakeholder engagement have been set in motion to address controversies surrounding tax laws. The committee firmly believes that solutions should be derived from the collaboration of Nigerians rather than relying on the courts for resolution.

Mr. Oyedele emphasized that the ongoing public consultation and stakeholder engagement are vital components of the reform process, stating, “We think that the solution will not come from the courts. It will come from Nigerians coming together to say actually, this is the best way to deal with these matters.”

One of the challenges highlighted by the committee is the need for constitutional amendments to support most of the proposed reforms. Additionally, there’s a lack of clarity regarding taxing rights between different levels of government. Addressing these issues is crucial to simplifying the tax structure and reducing financial leakages.

The move to reduce the number of officially collected taxes is not only about simplification but also efficiency. Mr. Oyedele noted that having a higher number of taxes doesn’t necessarily lead to increased revenue. In fact, it can create opportunities for financial leakages and unauthorised entities to collect funds for their own benefit.

The committee’s second phase report will unveil further critical reforms, including rewriting major tax laws to eliminate the issue of multiple taxes and levies. This substantial effort aligns with Nigeria’s broader goals to make taxation more efficient and less burdensome for its citizens.

- Tags: business, Tax, tax reform, Tinubu