The Central Bank of Nigeria has recommended using eNaira for cash transfers during the National Social Safety Net Plan Scale Up in an effort to promote a cashless economy.

This was stated in the National FinTech Strategy paper that was downloaded from the CBN website.

The National Financial Inclusion Steering Group, which is led by CBN Governor Godwin Emefiele, developed the plan blueprint.

The document disclosed that payments to the weak and destitute on the social registry might be pre-programmed for the eNaira.

It read, “The central bank can use a pre-programmed eNaira to pay intended beneficiaries on the social register, which could be accepted only for a specific purpose and at specifically authorised locations.

“This use case will ensure the proper use of social funds, ensure high-quality data can be collected on the performance of these programs, and help to prevent leakage or diversion of funds. This capability could be extended to other use cases in financial services and related ecosystems, where there exists a priority to maintain the integrity of funds and the purpose for which it is used.”

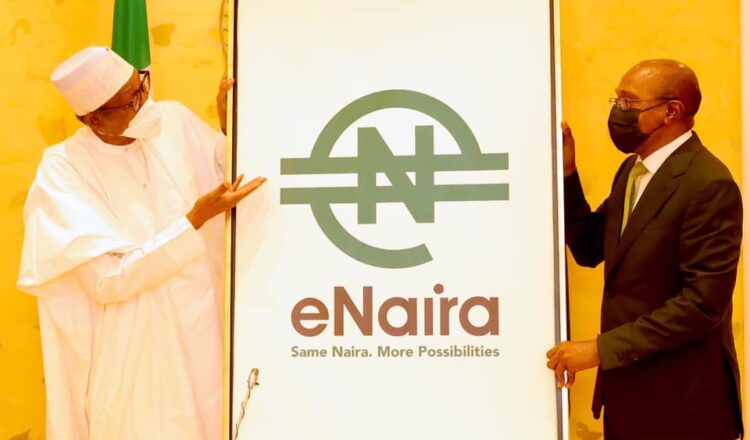

On October 25, 2021, the CBN unveiled eNaira, its central bank digital currency, with the goals of promoting financial inclusion, improving the effectiveness of payment systems for remittances and social assistance, and increasing income and tax collections.

According to the document, “In Nigeria, the eNaira objectives include monetary policy effectiveness, financial inclusion, payments and remittances efficiency (domestic and cross-border) and government payments.”

The National Social Safety Net Programme Scale Up, which would cost $800 million, is anticipated to begin operations in 2023 as soon as the National Assembly gives its blessing.

It was also verified on the World Bank website that the NASSP-SU was approved by the bank on December 16, 2021, and that it will be in effect until June 30, 2024.

The Federal Ministry of Humanitarian Affairs, Disaster Management, and Social Development is responsible for carrying out the $800 million initiative.

There were roughly 12.06 million poor and vulnerable households, with 49.81 million people in their database, according to data from the National Social Safety Net Coordination Office.